Best Piping Cutting Machine Price Automatic & Wire Straightening Cutting Machine Cost

- Introduction to piping cutting machine price

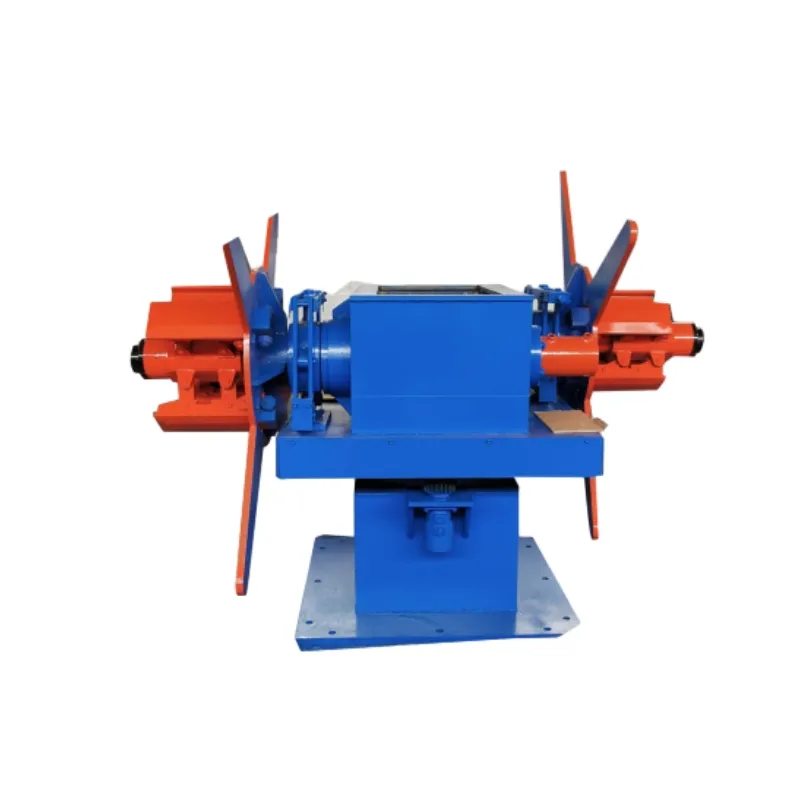

and market overview - Technical advantages and key features of modern pipe cutting machines

- Manufacturer comparison—exploring global market leaders

- Detailed price table for different types and models

- Customization solutions and integration possibilities

- Real-world case studies demonstrating value

- Conclusion and future outlook for piping cutting machine price trends

(piping cutting machine price)

Understanding the Piping Cutting Machine Price Landscape

In the rapidly evolving manufacturing sector, accurately assessing the piping cutting machine price has become critical for stakeholders and procurement professionals. The global piping fabrication machinery industry, estimated at $17.4 billion in 2023, continues its upward trajectory, propelled by automation, flexible production requirements, and swelling infrastructure investment. A widespread misconception is that only the initial machine cost should be considered; however, factors like automation, ease of integration, energy consumption, and after-sales service massively sway the total cost of ownership. As industries innovate, understanding prevailing automatic pipe cutting machine price ranges, alongside wire straightening and cutting machine price benchmarks, empowers engineers and buyers to make data-driven, cost-effective decisions for scalable business growth.

Cutting Edge: Technical Advantages and Modern Features

Today’s pipe cutting machines are engineered with features that maximize productivity and ensure precise results. State-of-the-art CNC pipe cutters offer automated servo-driven cutting heads, with tolerances as tight as ±0.05 mm even at high throughput. Notably, fiber laser models now slice stainless steel piping up to 12 mm thick at speeds exceeding 40 meters/minute—outperforming traditional plasma or blade systems. Most automatic pipe cutting machines incorporate smart material feed with advanced sensors that detect dimensional variances, minimizing defects and material waste by up to 18%.

Further advances include real-time diagnostics and predictive maintenance, reducing average machine downtime by 22% annually. Integration with ERP and MES platforms facilitates instant order processing and batch traceability. Some wire straightening and cutting machines now feature brushless DC motors, which cut energy usage by 15–25% compared to AC alternatives, and modular tooling that speeds up changeovers to under 10 minutes. Such features directly reduce labor and material costs, driving ROI for fabricators and component manufacturers alike.

Manufacturer Comparison: Global Market Leaders

Choosing the right equipment supplier is a line between operational excellence and recurring maintenance headaches. Market leaders such as BLM Group (Italy), Trumpf (Germany), Amada (Japan), and emerging players from China and South Korea dominate the segment. BLM’s LT series, for example, integrates robotics for complete cell automation, while Trumpf’s TruLaser Tube models emphasize high dynamic rigidity and software-driven optimization.

Conversely, Asian brands increasingly focus on affordability and rapid delivery cycles, targeting expanding markets in Southeast Asia, Africa, and the Middle East. Buyers should examine support networks, upgrade paths, and technical adaptation capabilities to specific job shop environments. Differentiation arises in after-sales service response times (ranging 24–72 hours), warranty terms, and available digital ecosystem partnerships.

Price Matrix: From Entry-Level to Fully Automated Solutions

| Machine Type | Model Example | Cutting Capacity | Technology | Avg. Price (USD) | Typical Annual Throughput |

|---|---|---|---|---|---|

| Manual Pipe Cutter | Ridgid 258 | Up to 6” (Steel) | Mechanical | $3,200 - $4,800 | 20,000 pieces |

| Semi-Automatic Pipe Cutter | SOCO SA-80 | Up to 8” (Alloy) | Cold Saw | $7,000 - $12,500 | 70,000 pieces |

| Automatic Pipe Cutting Machine | BLM LT Fiber | Up to 10” (Steel & Stainless) | Fiber Laser | $110,000 - $285,000 | 250,000 pieces |

| Wire Straightening & Cutting Machine | Chengyu GT Series | Up to 12 mm (Wire) | Servo-Drive | $9,500 - $19,800 | 1,200,000 pieces |

| CNC Plasma Pipe Cutter | Trumpf TruLaser Tube 5000 | Up to 8” (All Metals) | Plasma/Laser Hybrid | $180,000 - $320,000 | 325,000 pieces |

The table above illustrates how piping cutting machine price correlates with automation degree, throughput, and technical sophistication. Strategic investments often recoup their value within 18–36 months, factoring in operational cost reductions and production scale-up.

Customization Solutions: Meeting Unique Production Needs

Manufacturers worldwide increasingly demand machines tailored to unique manufacturing footprints, resulting in the surge of specialized customization services. Leading OEMs offer options ranging from extended pipe bed lengths (up to 12 meters), fully automated loading/unloading modules, and hybrid cutting heads to handle steel, copper, aluminum, and composites in one configuration. Software customization is crucial for organizations that require integration with proprietary production management systems, enabling seamless workflow from order intake to dispatch.

Wire straightening and cutting machine price can be affected by custom modules such as multi-diameter rollers, high-output servo feeders, and real-time defect rejection systems. Customers can specify granular process parameters—down to cutting angle tolerances, feed rates, or material-specific thermal compensation—to achieve targeted production outcomes. Global supply chains also favor modular machine platforms, which can be easily upgraded as business needs evolve, averting sunk capital costs associated with fixed-architecture systems.

Most reputable manufacturers offer remote installation support and comprehensive training so that operators can quickly master advanced controls, shortening the learning curve while maintaining safety and productivity.

Application Cases: Piping Cutting Machines in Action

Concrete examples underscore the practical impact of selecting the correct cutting technology. In 2022, a large HVAC ductwork supplier in North America integrated five fiber laser cutting systems, slashing setup time by 60% and reducing material scrap by 22%. Similarly, a Middle Eastern construction conglomerate adopted advanced wire straightening and cutting machines, boosting annual output by 35% and nearly halving unplanned downtime through built-in self-diagnostics.

Automotive suppliers using automatic pipe cutting machines with robotic cells report cycle time reductions from 45 seconds per part to just 12 seconds, with traceability and quality assurance features ensuring compliance with ISO 9001 requirements. In heavy machinery, the shift to CNC-driven plasma cutters saw a fabricator improve cut edge quality and decrease rework rates by more than 25%, directly enhancing delivery reliability and customer satisfaction. These real-world deployments reflect how strategic equipment choice directly elevates businesses across the engineering and construction spectrum.

Future Outlook: The Evolving Piping Cutting Machine Price Equation

As global manufacturing enters a new phase of digital transformation, the piping cutting machine price will increasingly reflect shifts in technology, supply chain dynamics, and customer ambition. The emergence of Industry 4.0, with its emphasis on connected equipment, remote monitoring, and data-driven optimization, is expected to raise the value curve—buyers may pay a premium upfront, but total lifecycle costs continue to fall due to higher uptime and efficiency. OEMs respond to this demand with flexible financing, leasing models, and service-backed contracts that minimize initial financial barriers and pivot focus toward sustained value creation.

In summary, investing in the right cutting solution—whether focused on pipes, tubes, or wires—translates into competitive advantage and resilience in a marketplace defined by precision, adaptability, and relentless innovation. As the sector advances, detailed price evaluations, hands-on customization, and case-aligned technology selection will empower organizations to excel in their chosen fields, confidently navigating the intricate world of piping cutting machine price analytics.

(piping cutting machine price)

FAQS on piping cutting machine price

Q: What factors influence the piping cutting machine price?

A: The price of a piping cutting machine depends on its cutting capacity, brand, automation level, and additional features. Generally, advanced models with high precision and speed cost more. Delivery and after-sales service may also affect the final price.Q: How much does an automatic pipe cutting machine cost?

A: Automatic pipe cutting machine price usually ranges from $3,000 to $20,000 based on specifications and functionalities. Fully automated and CNC machines are priced at the higher end. Request quotes from suppliers for exact pricing.Q: What is the typical price range for a wire straightening and cutting machine?

A: Wire straightening and cutting machine prices typically start around $2,000 and can go up to $15,000. The cost varies by processing speed, machine size, and degree of automation. Customized options may be more expensive.Q: Where can I find affordable piping cutting machine prices?

A: You can compare piping cutting machine prices from online industrial marketplaces, direct manufacturers, or local distributors. Look for deals, discounts, and after-sales support. Ask for quotations and check reviews before purchasing.Q: Are there differences in price between manual and automatic pipe cutting machines?

A: Yes, automatic pipe cutting machines are generally more expensive than manual models. Automation offers higher efficiency and precision, justifying the price difference. Consider your production needs to choose the right type within your budget.-

Tube Straightening Machine Working Principle & Advantages Efficient Scaffold Tube Straightening SolutionsNewsJun.24,2025

-

Top Straightening Machine Supplier – High Precision Solutions for Metal ProcessingNewsJun.10,2025

-

High Efficiency Rotary Shear Machine for Precision Cutting Versatile Rotary Shear Shredder & Cordless OptionsNewsJun.10,2025

-

High-Precision Cold Rolled Steel Machine for Quality ProductionNewsJun.09,2025

-

Metal Tube Making Machine – High Precision & AutomationNewsJun.09,2025