Cost-Effective Shutter Machine Price Quality & Quote

- Factors influencing shutter machinery cost and market variability

- Technical advantages enhancing production efficiency

- Price impact analysis across different material applications

- Comparative evaluation of leading manufacturers

- Customization options for specialized manufacturing needs

- Real-world implementation case studies

- Strategies for optimal purchasing decisions

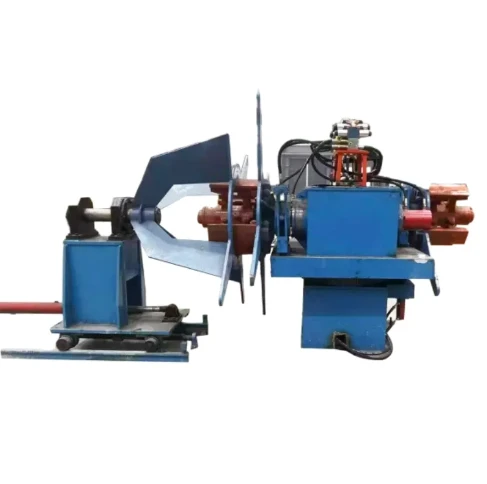

(shutter machine price)

Understanding Shutter Machine Price Dynamics

Investing in rolling shutter manufacturing equipment involves navigating complex price variables influenced by several critical factors. Production capacity stands as a primary determinant, where machines outputting 400-500 panels per command shift typically command 25-30% higher costs compared to models with 200-unit capacity. Material compatibility equally impacts expenditure - units processing thicker aluminum profiles (1.2-1.5mm) require heavier-duty components that add 18-22% to the base rate. Recent energy efficiency upgrades further contribute to cost structures, with newer models featuring servo motors yielding 12-15% higher prices than traditional hydraulic alternatives despite reducing operational expenses significantly.

Engineering Excellence Driving Performance

Advanced technical features increasingly differentiate premium shutter machines from economy alternatives. Models incorporating PLC automation with human-machine interfaces (HMIs) provide superior precision control during profile cutting and punching operations. CNC-guided position control systems guarantee dimensional accuracy within ±0.2mm tolerance compared to ±0.5mm in conventional machines - critical for components requiring perfect interlocking capabilities. Manufacturers now integrate multi-stage roller systems that simultaneously perform multiple operations on shutter profile components, boosting throughput by 40% while reducing manual intervention. Enhanced safety mechanisms including optical barriers and automatic tool withdrawal protect operators during high-speed production cycles.

Price Performance Across Different Requirements

Application variations generate significant price divergence across shutter equipment categories. Standard rolling shutter machines for residential profiles typically range between $20,000-$35,000. However, specialized patti making machines featuring automated coiling systems command higher rates between $28,000-$45,000 due to their intricate gear systems for custom slat formation. Industrial-grade systems capable of processing commercial-grade aluminum extrusions (over 230mm width) reach $55,000-$80,000 as they incorporate hydraulic intensifiers and reinforced roller cages. Secondary accessories like automatic lubrication stations and quick-change tooling kits add another 12-15% to base pricing while prolonging operational life by 30%.

Manufacturer Technology Comparison

| Manufacturer | Max Profile Width | Production Speed | Motor Type | Price Range ($) |

|---|---|---|---|---|

| Gurmeet Machinery | 250mm | 12m/min | Servo-controlled | 34,000 - 48,000 |

| Rollform India | 200mm | 9m/min | Hydraulic | 24,500 - 38,000 |

| Raj India Industries | 300mm | 15m/min | Hybrid Drive | 45,000 - 67,000 |

| Venus Automation | 180mm | 7m/min | Conventional | 18,000 - 28,000 |

Tailored Manufacturing Solutions

Custom configuration options present viable pathways for balancing specialized production requirements with budget considerations. Manufacturers increasingly offer modular designs where clients can implement staged upgrades - beginning with standard roller shutter machines at $22,000 and later integrating CNC punching stations for an additional $6,500. Material-specific tooling packages present another customization tier: galvanized steel packages add $3,000-$4,500 while dual-material configurations allow interchangeable production between aluminum and PVC profiles for $7,200 surcharge. Manufacturers now report 60% of clients opting for custom automation packages incorporating profile stackers that increase setup costs by 15% but reduce labor requirements by two workers per production shift.

Industry Implementation Success Stories

AluForm Solutions witnessed production transformation after upgrading to servo-powered shutter profile machinery priced at $52,000. Their Bangalore facility automated the formation of interlocking shutter slats with 0.15mm precision tolerances, reducing material waste from 12.3% to 4.1% within eight months. Similarly, SecureShield Industries invested $78,500 in heavy-duty rolling shutter making machines with advanced coiling mechanisms. Their Mumbai plant increased output from 1,200 to 3,700 panels daily while improving joint integrity for security-grade shutters. Coastal manufacturers frequently report preference for machines certified against salt corrosion, accepting 10-12% price premiums for marine-compliant units that maintain operational reliability in humid environments beyond standard warranties.

Strategically Approaching Shutter Machine Price Considerations

Evaluating shutter machinery investment requires comprehensive analysis beyond listed price points. Factoring in maintenance contracts typically adds 3.5-5% annually but prevents expensive breakdowns - operators should verify component warranty durations differ significantly among manufacturers. Energy consumption analysis reveals substantial differences: servo-equipped machines consume approximately 9.8kWh compared to hydraulic models requiring 15.6kWh for equivalent output. Production facilities generating 200+ panels daily typically recover automation premiums within 14-18 months through reduced labor and waste expenses. Ultimately, the true shutter machine price

reflects the operational efficiency achieved when balancing technology investments against specific production volume requirements.

(shutter machine price)

FAQS on shutter machine price

Q: What factors influence shutter machine prices?

A: Shutter machine prices vary based on production capacity, automation level, and brand reputation. Higher RPM configurations and servo-motor systems typically increase costs. Material thickness capabilities also significantly impact final pricing.

Q: How much does a shutter profile making machine cost?

A: Shutter profile making machines typically range from $15,000 to $60,000 USD. Entry-level manual models start around $15,000, while fully automated production lines with servo controls can exceed $50,000. Prices depend on tooling configurations and material compatibility.

Q: What is the price range for rolling shutter making machines?

A: Rolling shutter making machines cost between $18,000 and $75,000 depending on features. Basic single-function units are most affordable, while integrated systems that perform slat forming, punching, and cutting simultaneously command premium pricing. Import duties may add 5-15% to final costs.

Q: Why do shutter patti making machine prices vary so widely?

A: Shutter patti machine prices vary due to production speed (100-600 pieces/hour) and material thickness handling (0.3mm-1.2mm). Hydraulic vs pneumatic systems create $5,000-$10,000 differences, while brand-new versus refurbished equipment can halve the investment.

Q: Are there budget options for shutter machinery under $20,000?

A: Yes, basic manual shutter machines start around $12,000-$20,000. These typically handle light-gauge materials (up to 0.8mm) with production speeds under 150 components/hour. Semi-automatic models near the $20,000 mark offer improved consistency for small workshops.

-

Advanced Rolling Mill Machine Precision Cold Rolling SolutionsNewsJun.06,2025

-

Portable Metal Roof Roll Forming Machine Sale Mobile & EfficientNewsJun.06,2025

-

Powerful Hydraulic Angle Iron Shear for Metal CuttingNewsJun.06,2025

-

Roll Forming Tube Machines Precision Efficiency & Custom SolutionsNewsJun.05,2025

-

Used Standing Seam Roll Forming Machine Affordable & ReliableNewsJun.05,2025

-

Precision Steel Rod Straightening Machine for High AccuracyNewsJun.05,2025